Attributes and Key Statistics of the India Housing Loan Market Report by IMARC Group:

Base Year: 2024

Forecast Years: 2025-2033

Historical Years: 2019-2024

Units: USD Billion

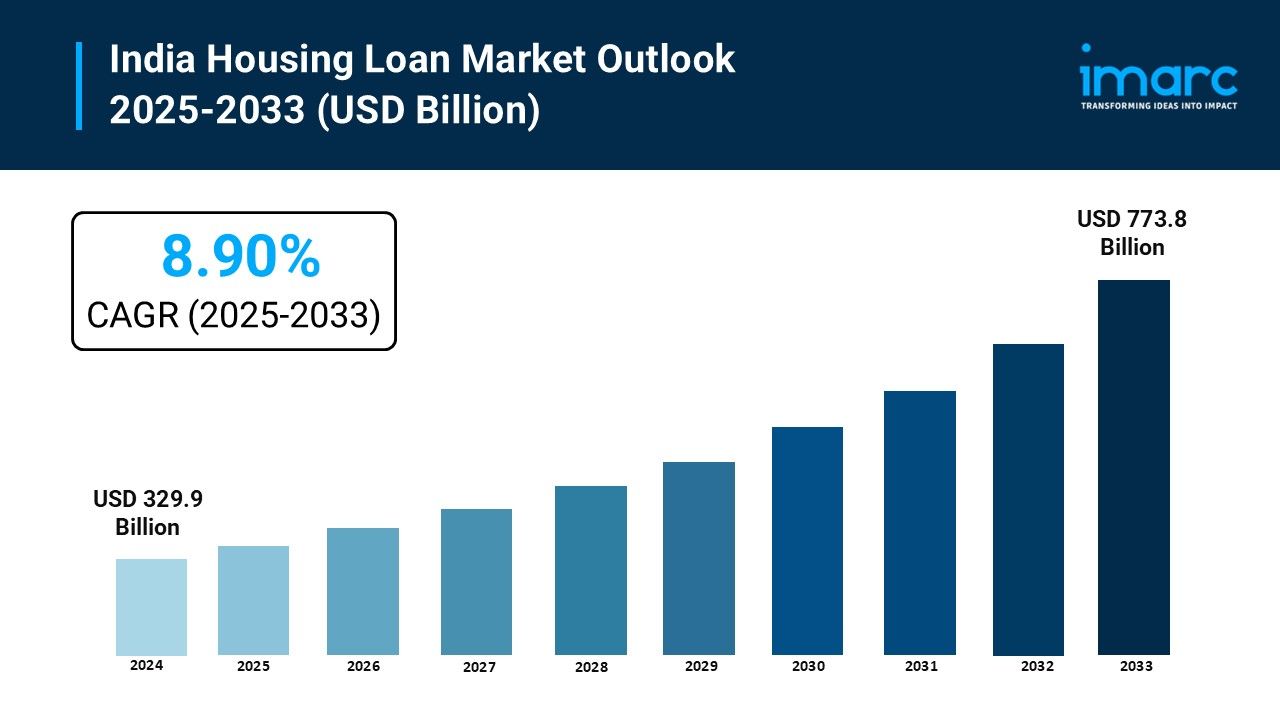

Market Size in 2024: USD 329.9 Billion

Market Forecast in 2033: USD 773.8 Billion

Market Compound Annual Growth Rate 2025-2033: 8.90%

As indicated in the latest market research report published by IMARC Group, titled “India Housing Loan Market Size, Share, Trends and Forecast by Type, Customer Type, Source, Interest Rate, Tenure, and Region, 2025-2033,” this report provides an in-depth analysis of the industry, featuring insights into the market. It encompasses competitor and regional analyses, as well as recent advancements in the market.

India Housing Loan Market Size & Future Growth Potential:

The India housing loan market size was valued USD 329.9 Billion in 2024. By 2033, this figure is projected to reach around USD 773.8 Billion, with a compound annual growth rate (CAGR) of 8.90% over the forecast period (2025-2033).

Core Factors Driving Market Trends:

The India housing loan market is currently characterized by a dynamic shift in consumer preferences and digital innovation, driven by a deep understanding of borrower needs. A significant trend is the rising demand for affordable housing, fueled by government initiatives like the Pradhan Mantri Awas Yojana (PMAY), which has incentivized first-time homebuyers in tier-II and tier-III cities. Furthermore, financial institutions are demonstrating enhanced expertise by leveraging advanced data analytics and artificial intelligence to offer personalized loan products, streamline credit assessment, and significantly reduce turnaround times.

The market is also witnessing a surge in the popularity of flexible repayment options, such as step-up and step-down EMIs, which cater to the varying income cycles of young, salaried professionals. Additionally, the competitive landscape has intensified with non-banking financial companies (NBFCs) and housing finance companies (HFCs) offering highly customized solutions, compelling public and private sector banks to adopt more agile and customer-centric approaches. This evolution underscores the market's authoritative move towards a more inclusive, technology-driven ecosystem that prioritizes transparency and customer satisfaction, building considerable trust among potential homeowners.

India Housing Loan Market Scope and Growth:

The scope for the India housing loan market remains exceptionally broad, underpinned by strong fundamental growth drivers that promise sustained expansion. A young, aspirational population, rapid urbanization, and rising disposable incomes form a powerful foundation for long-term demand, ensuring the market's relevance. The persistent gap between housing demand and supply presents a substantial opportunity for lenders to penetrate deeper into underserved segments. Moreover, the gradual expansion of credit facilities to the self-employed and informal sector segments, once considered high-risk, illustrates the market's growing maturity and sophisticated risk assessment capabilities.

In addition, the increasing willingness of banks to finance projects from reputable developers has improved buyer confidence and unlocked new avenues for growth. The market's authoritative strength is further validated by the stable regulatory environment maintained by the Reserve Bank of India (RBI) and the National Housing Bank (NHB), which ensures systemic stability and protects borrower interests. This combination of demographic dividends, financial inclusion, and robust regulation creates a trustworthy and expansive growth trajectory for the Indian housing finance sector, making it a cornerstone of the nation's economic development.

Request Free Sample Report: https://www.imarcgroup.com/india-housing-loan-market/requestsample

Comprehensive Market Report Highlights & Segmentation Analysis:

The market report offers a comprehensive analysis of the segments, highlighting those with the largest India housing loan market share. It includes forecasts for the period 2025-2033 and historical data from 2019-2024 for the following segments.

Type Insights:

- Home Purchase

- Land/ Plot Purchase

- Home Construction

- Home Improvement

- Home Extension

- Others

Customer Type Insights:

- Salaried

- Self-Employed

Source Insights:

- Bank

- Housing Finance Companies (HFCs)

Interest Rate Insights:

- Below 10%

- Above 10%

Tenure Insights:

- Below 5 Years

- 5 to below 10 Years

- 10 to 20 Years

- Above 20 Years

Breakup by Region:

- North India

- South India

- West and Central India

- East India

Competitor Landscape:

The report offers an in-depth examination of the competitive landscape. It includes a thorough competitive analysis encompassing market structure, key player positioning, leading strategies for success, a competitive dashboard, and a company evaluation quadrant.

Key highlights of the Report:

- Historical Market Performance

- Future Market Projections

- Impact of COVID-19 on Market Dynamics

- Industry Competitive Analysis (Porter’s Five Forces)

- Market Dynamics and Growth Drivers

- SWOT Analysis (Strengths, Weaknesses, Opportunities, Threats)

- Market Ecosystem and Value Creation Framework

- Competitive Positioning and Benchmarking Strategies

Major Advantages of the Report:

- This report provides market leaders and new entrants with accurate revenue estimates for the overall market and its key subsegments.

- Stakeholders can leverage this report to gain a deeper understanding of the competitive landscape, enabling them to strategically position their businesses and develop effective go-to-market strategies.

- The report provides stakeholders with valuable insights into the market dynamics, offering a comprehensive analysis of key drivers, restraints, challenges, and opportunities.

Why Choose IMARC Group:

- Extensive Industry Expertise

- Robust Research Methodology

- Insightful Data-Driven Analysis

- Precise Forecasting Capabilities

- Established Track Record of Success

- Reach with an Extensive Network

- Tailored Solutions to Meet Client Needs

- Commitment to Strong Client Relationships and Focus

- Timely Project Delivery

- Cost-Effective Service Options

Note: Should you require specific information not included in the current report, we are pleased to offer customization options to meet your needs.

Contact Our Analysts for Brochure Requests, Customization, and Inquiries Before Purchase: https://www.imarcgroup.com/request?type=report&id=31405&flag=C

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Contact US

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

America: +1-201971-6302 | Africa and Europe: +44-702-409-7331