India Consumer Credit Market 2025-2033

According to IMARC Group's report titled "India Consumer Credit Market Size, Share, Trends and Forecast by Credit Type, Service Type, Issuer, Payment Method and Region, 2025-2033", The report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

How Big is the India Consumer Credit Industry ?

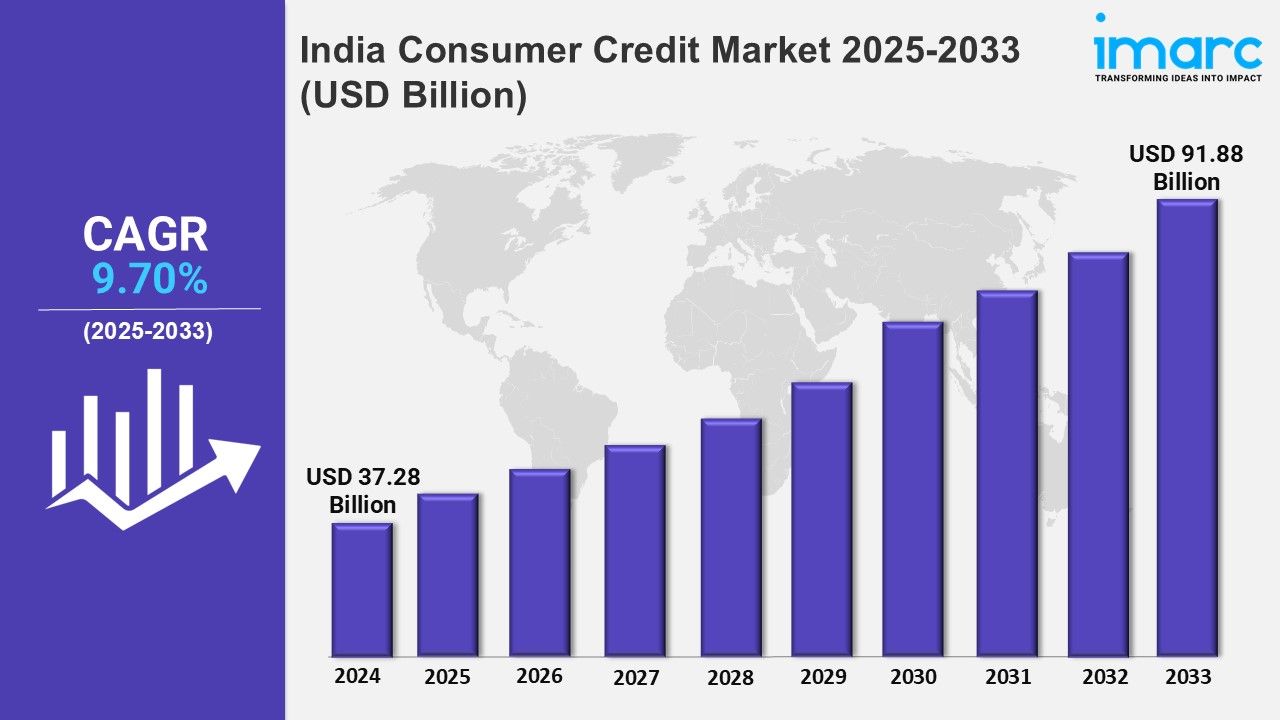

The India consumer credit market size was valued at USD 37.28 Billion in 2024 and is projected to grow to USD 91.88 Billion by 2033, with an expected compound annual growth rate (CAGR) of 9.70% from 2025 to 2033.

Request Free Sample Report: https://www.imarcgroup.com/india-consumer-credit-market/requestsample

India Consumer Credit Market Trends:

India consumer credit market is also significantly changing due to changing consumer preferences, the adoption of the digital environment, and regulators. Among the most noticeable tendencies is the speed in which digital lending platforms are expanding with the usage of innovative technologies such as AI and machine learning that enable more efficient loans approvals and disbursements. The fintech firms are in the frontline of opening up credit to the underserved with the example of reach out to small-town borrowers or the millennials. Moreover, the emergence of Buy Now, Pay Later (BNPL) solutions has transformed the way the population spends its money and provides pay-in-installments schemes related to e-commerce and retail.

Traditional banks and NBFCs are henceforth partnering with fintech companies in order to become more digitalized and create better customer experience. Another major trend is increased demand in unsecured loans such as personal loans and credit cards since consumers need faster financing to finance their lifestyle needs and emergencies. Besides, new rules issued by regulators such as the RBI digital lending policy are further promoting the transparency and trust in this market. The transition to a paperless and immediate loan processing operation is also driving faster market growth, with mobile applications and UPI-based services becoming favourable loan transaction channels among borrowers. Additionally, the increase in disposable income coupled with the urbanization are driving credit demand in Tier 2 and Tier 3 cities suggesting a shift of the market beyond the metros.

India Consumer Credit Market Scope and Growth:

The Indian consumer credit market is full of high growth potential, with young population, growth in financial literacy and the well developed digital infrastructure. There is also a spurt in demand in personal loans, auto loans, consumer durable financing and many other types of credit on offer. Also, the growing middle class population is encouraging greater consumption, which increases credit intake. Furthermore, the trend toward financial inclusion because of other schemes such as Jan Dhan Yojana and Aadhaar based banking has led to increasing access to credit within the rural and semi-urban areas. The entry of neo-banks and the global fintech players is heightening the competition further in the form of new credit products that can better fit with the needs of the consumers.

Furthermore, lenders are adopting other forms of credit scoring model, which can access and evaluate non-traditional information such as utility payments and social media activities, in order to target their services to thin-file customers. The emergence of co-lending arrangements between banks and NBFCs is also maximizing and economizing risk-sharing and credit distribution. Moreover, growing smartphone penetration and cheap over-the-internet connection are allowing smooth digital loan applications making them less dependent on the physical branch. As the India consumer credit market is set to grow steadily owing to sustained economic growth and changing consumer behavior- it offers appetizing opportunities to lenders and investors.

We explore the factors propelling the India consumer credit market growth, including technological advancements, consumer behaviors, and regulatory changes.

India Consumer Credit Market Forecast and Segmentation:

The market report offers a comprehensive analysis of the segments, highlighting those with the largest India consumer credit market share. It includes forecasts for the period 2025-2033 and historical data from 2019-2024 for the following segments.

Credit Type Insights:

- Revolving Credits

- Non-revolving Credits

Service Type Insights:

- Credit Services

- Software and IT Support Services

Issuer Insights:

- Banks and Finance Companies

- Credit Unions

- Others

Payment Method Insights:

- Direct Deposit

- Debit Card

- Others

Regional Analysis:

- North India

- West and Central India

- South India

- East and Northeast India

Competitor Landscape:

The report offers an in-depth examination of the competitive landscape. It includes a thorough competitive analysis encompassing market structure, key player positioning, leading strategies for success, a competitive dashboard, and a company evaluation quadrant.

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=30743&flag=C

Other key areas covered in the report:

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Market Dynamics

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

- Top Winning Strategies

- Recent Industry News

- Key Technological Trends & Development

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302