Attributes and Key Statistics of the India Car Loan Market Report by IMARC Group:

Base Year: 2024

Forecast Years: 2025-2033

Historical Years: 2019-2024

Units: USD Billion

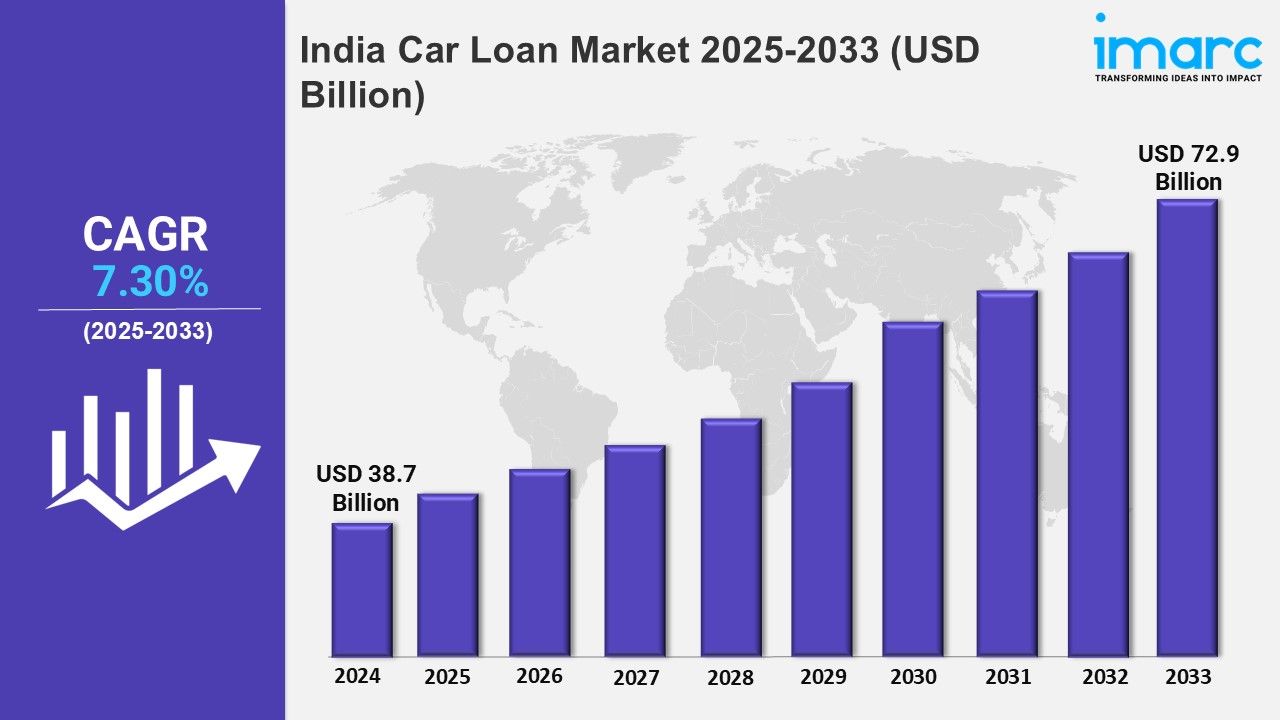

Market Size in 2024: USD 38.7 Billion

Market Forecast in 2033: USD 72.9 Billion

Market Compound Annual Growth Rate 2025-2033: 7.30%

As indicated in the latest market research report published by IMARC Group, titled “India Car Loan Market Size, Share, Trends and Forecast by Type, Car Type, Provider Type, Tenure, and Region, 2025-2033,” this report provides an in-depth analysis of the industry, featuring insights into the market. It encompasses competitor and regional analyses, as well as recent advancements in the market.

India Car Loan Market Size & Future Growth Potential:

The India car loan market size was valued USD 38.7 Billion in 2024. By 2033, this figure is projected to reach around USD 72.9 Billion, with a compound annual growth rate (CAGR) of 7.30% over the forecast period (2025-2033).

Request Free Sample Report: https://www.imarcgroup.com/india-car-loan-market/requestsample

Core Factors Driving Market Trends:

The India car loan market is subject to dynamic trends as digital advancements and evolving consumer preferences drive it. Rising incomes with easier financing access allow more individuals to purchase vehicles with car loans. For attracting customers, banks and non-banking financial companies (NBFCs) are offering competitive interest rates. Options for more flexible repayment are also being offered now. Borrowing is now simpler; customers enjoy greater convenience. Because of pre-approved loans and doorstep services, the popularity grew causing this streamlining. Paperless processes help digital lending platforms gain traction since they allow faster approvals and disbursements.

Also, lenders are introducing loan products that are specialized, having terms of attraction because of demand that is increasing for EVs. One other trend is the shift toward used car financing as affordability-conscious buyers explore pre-owned vehicles. With customary lenders, fintech collaborations are improving accessibility. This sort of improvement is particularly noticeable in both semi-urban and rural areas. Tailored schemes as well as incentives drive a surge in women borrowers in the market too. These trends show a financial ecosystem adapts rapidly also prioritizes speed, flexibility, together with inclusivity to meet diverse consumer needs.

India Car Loan Market Scope and Growth Analysis:

The India car loan market has important growth potential, for urbanization then expands and also a middle class burgeons. Since vehicle ownership has become a key aspiration, lenders are capitalizing upon this demand by introducing revolutionary financing solutions. Past metropolises, the market stretches because tier-2 and tier-3 cities become high-growth regions having higher incomes plus better infrastructure. Additionally, the entry of more new players, such as digital-only lenders, has strengthened the competition, and this now leads to much better customer-centric offerings.

Furthermore, government initiatives that promote financial inclusion as well as GST reductions on vehicles have further stimulated market expansion. The used car segment grows in a substantial way, as lenders loan in an attractive manner with high ratios and also with extended tenures. In addition, partnerships of automakers together with financial institutions foster smooth loan approvals within dealerships, and also buyer confidence becomes improved. Subscription models and balloon payment plans are reshaping how repayments get structured too. These models and schemes cater for varied financial capabilities. Digitization is growing with risk-based pricing in focus so the market can sustain growth. This growth offers ample opportunities to lenders since they can innovate and expand their customer base.

Comprehensive Market Report Highlights & Segmentation Analysis:

The market report offers a comprehensive analysis of the segments, highlighting those with the largest car loan market share in india. It includes forecasts for the period 2025-2033 and historical data from 2019-2024 for the following segments.

Type Insights:

- New Car

- Used Car

Car Type Insights:

- SUV

- Hatchback

- Sedan

Provider Type Insights:

- OEM (Original Equipment Manufacturers)

- Banks

- NBFCs (Non Banking Financials Companies)

Tenure Insights:

- Less Than 3 Years

- 3-5 Years

- More Than 5 Years

Regional Insights:

- North India

- South India

- East India

- West India

Competitor Landscape:

The report offers an in-depth examination of the competitive landscape. It includes a thorough competitive analysis encompassing market structure, key player positioning, leading strategies for success, a competitive dashboard, and a company evaluation quadrant.

Key highlights of the Report:

- Historical Market Performance

- Future Market Projections

- Impact of COVID-19 on Market Dynamics

- Industry Competitive Analysis (Porter’s Five Forces)

- Market Dynamics and Growth Drivers

- SWOT Analysis (Strengths, Weaknesses, Opportunities, Threats)

- Market Ecosystem and Value Creation Framework

- Competitive Positioning and Benchmarking Strategies

Major Advantages of the Report:

- This report provides market leaders and new entrants with accurate revenue estimates for the overall market and its key subsegments.

- Stakeholders can leverage this report to gain a deeper understanding of the competitive landscape, enabling them to strategically position their businesses and develop effective go-to-market strategies.

- The report provides stakeholders with valuable insights into the market dynamics, offering a comprehensive analysis of key drivers, restraints, challenges, and opportunities.

Why Choose IMARC Group:

- Extensive Industry Expertise

- Robust Research Methodology

- Insightful Data-Driven Analysis

- Precise Forecasting Capabilities

- Established Track Record of Success

- Reach with an Extensive Network

- Tailored Solutions to Meet Client Needs

- Commitment to Strong Client Relationships and Focus

- Timely Project Delivery

- Cost-Effective Service Options

Note: Should you require specific information not included in the current report, we are pleased to offer customization options to meet your needs.

Contact Our Analysts for Brochure Requests, Customization, and Inquiries Before Purchase: https://www.imarcgroup.com/request?type=report&id=5001&flag=C

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Contact US

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

Americas: +1-201971-6302 | Africa and Europe: +44-702-409-7331