Australia Fintech Market Outlook

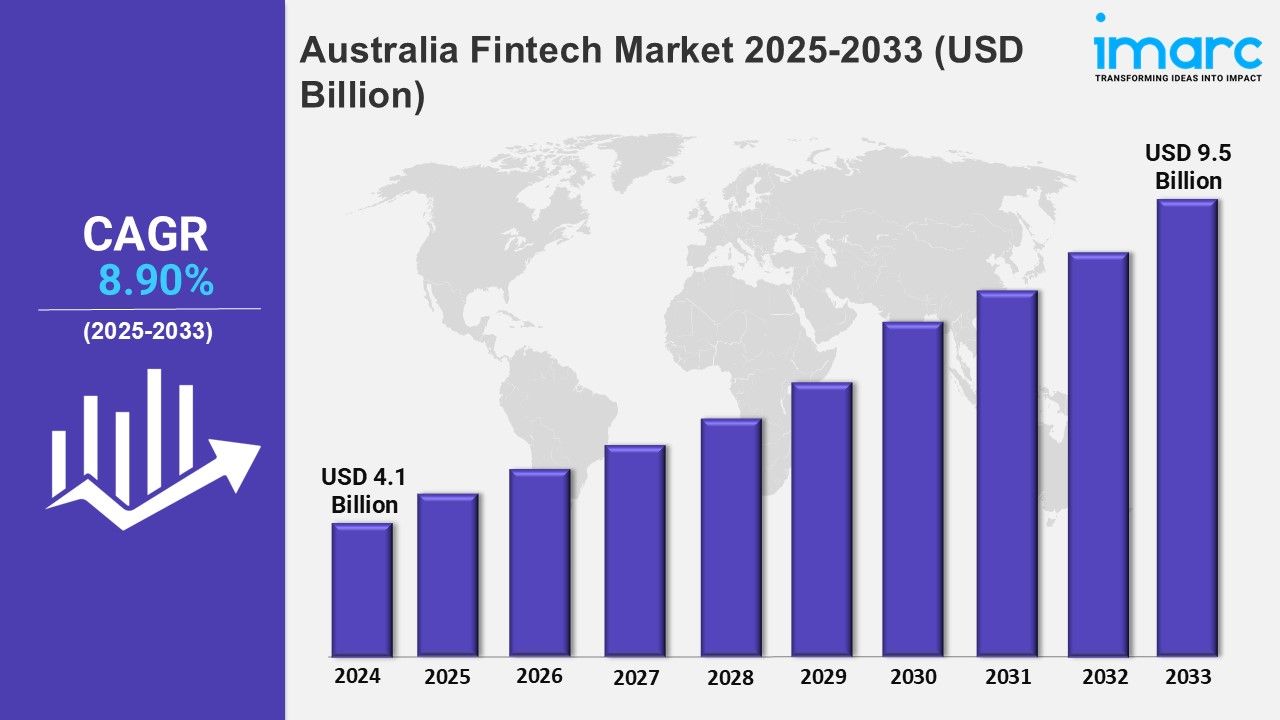

Base Year: 2024

Historical Years: 2019-2024

Forecast Years: 2025-2033

Market Size in 2024: USD 4.1 Billion

Market Forecast in 2033: USD 9.5 Billion

Market Growth Rate: 8.90% (2025-2033)

The Australia fintech market size was valued at USD 4.1 Billion in 2024 and is projected to grow to USD 9.5 Billion by 2033, with an expected compound annual growth rate (CAGR) of 8.90% from 2025 to 2033.

Australia Fintech Market Trends:

The Australian Fintech market is currently experiencing substantial shifts excited by rapidly developing technological advancement and evolving consumer preferences. Digital payments, such as the use of mobile wallets and contactless payments, are manifested in a trend towards cashless transactions and widely adopted. Consumer data right (CDR) is driving open banking through an enabled framework, where consumers can share their financial data with third parties safely, creating competition and encouraging individual services. Growing interest in decentralized finance (Defi) and digital assets and blockchain and cryptocurrency is also paving the way to markets.

Additionally, the emergence of buy-now pay-later (BNPL) platforms has transformed traditional lending models for young consumers who are enamoured by technology. The use of artificial intelligence and machine learning is also being brought to detecting fraud, credit scoring and customer service, while the use of regulatory sandbox is enabling the creation of startups that can test new solutions. Collaboration between fintech companies and traditional banks is increasing to create a hybrid ecosystem of flexibility and established trust. The interplay of these trends highlights Australia's position as a vibrant hub for Fintech innovation driven by a supportive regulatory landscape and technology-skilled consumer base.

For an in-depth analysis, you can refer free sample copy of the report: https://www.imarcgroup.com/australia-fintech-market/requestsample

Australia Fintech Market Scope and Growth Analysis:

Australia Fintech Market provides immense development ability, supported by a strong digital infrastructure and a strong hunger for financial innovation. Both retail and commercial customers are expanding the market in various sections including catering, payment, loan, money management and Insurtech. Small and medium -sized enterprises (SMEs) are adopting fintech solutions for rapid operation and streamlining access funding, while consumers are embracing digital equipment for budget, investment and management. Government initiatives, such as CDR and Fintech-friendly rules, are promoting a favorable environment equally for startups and installed players.

Cross-border partnerships and investment are moving forward, as Australian Fintech firms detect international markets and attract global funding. The growing emphasis on financial inclusion is also running innovation, addressing an underestmented population with fintech solutions. With a high smartphone penetration rate and culture of initial technology, Australia is well deployed to maintain its fintech development trajectory, providing attractive opportunities for stakeholders in the ecosystem.

By the IMARC Group, the Top Competitive Landscapes Operating in the Industry:

- Afterpay

- Airwallex Pty Ltd

- Athena Mortgage Pty Ltd

- Divipay Pty Ltd

- Judo Bank Pty Ltd (Judo Capital Holdings)

- mx51 Pty Ltd

- PTRN Pty Ltd

- Stripe Inc.

- Wise Australia Pty Ltd

- Zeller Australia Pty Ltd.

Australia Fintech Industry Segmentation:

The market report offers a comprehensive analysis of the segments, highlighting those with the largest Australia fintech market share. It includes forecasts for the period 2025-2033 and historical data from 2019-2024 for the following segments.

Breakup by Deployment Mode:

- Cloud

- On-Premises

In 2024, the on-premises segment dominates the market, accounting for approximately 70.7% of the total market share, highlighting its continued strong industry presence.

Breakup by Technology:

- Application Programming Interface (API)

- Artificial Intelligence (AI)

- Blockchain

- Data Analytics

- Robotic Process Automation (RPA)

- Others

In 2024, data analytics is expected to dominate the market, driving innovation, strategic decision-making, and competitive advantage across various industries and global sectors.

Breakup by Application:

- Payments and Fund Transfer

- Loans

- Insurance and Personal Finance

- Wealth Management

- Others

In 2024, the payments and fund transfer segment dominates the market, capturing approximately 43.2% of the total market share, leading all other categories significantly.

Breakup by End-User:

- Banking

- Insurance

- Securities

- Others

In 2024, the banking sector dominates the market, capturing approximately 55.3% of the total market share, making it the leading industry by a significant margin.

Breakup by States:

- New South Wales

- Victoria

- Queensland

- Western Australia

- South Australia

- Tasmania

- Others

In 2024, New South Wales emerged as the leading region, capturing the highest market share by contributing more than 45.0% to the overall market.

Competitor Landscape:

The report offers an in-depth examination of the competitive landscape. It includes a thorough competitive analysis encompassing market structure, key player positioning, leading strategies for success, a competitive dashboard, and a company evaluation quadrant.

Ask Analyst For Customization: https://www.imarcgroup.com/request?type=report&id=6065&flag=C

Other key areas covered in the report:

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Market Dynamics

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

- Top Winning Strategies

- Recent Industry News

- Key Technological Trends & Development

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145